Annual net income formula

Annual Percentage Rate APR Formula. Net Operating Income - NOI.

Net Income Ni Definition Calculation Formula Finance Strategists

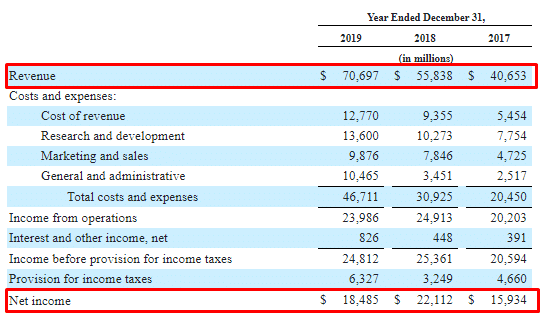

To calculate the concept of net operating income in the case of a real-life company.

. Your DTI which is expressed as a percentage measures how much of your gross monthly income is allocated toward debt repayment. An income approach valuation formula is to calculate a companys present value of cash flow. You also found that you had 2000 in deductions 500 for insurance coverage medical dentalvision and 1000 for retirement.

Net operating income NOI is a calculation used to analyze real estate investments that generate income. Similarly we can calculate gross profit operating income and net income for 2017 2018 and also you can refer to the below given excel template for the same. Determine an individuals annual income after taxes.

This equation net cash flows for a single year with perpetual growth. Earnings before interest and text 35 058 000. Net profits are defined as the net income from the operation of a business profession or Tax Reform Code of 1971 and regulations in 61 PA.

To calculate operating income you would use the. Income before tax 36 474 000. Besides his annual income includes rent of 4000 and interest on a savings bank account of 1000.

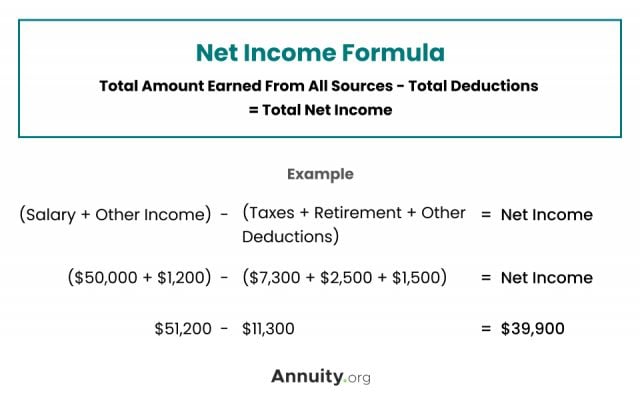

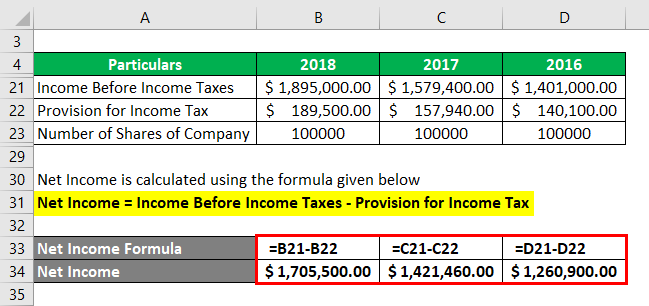

Expenses include deductions like local state and federal taxes pre-tax healthcare premium payments and social security. Annual net income Gross income Expenses Additional income. Net Income Formula Example 1.

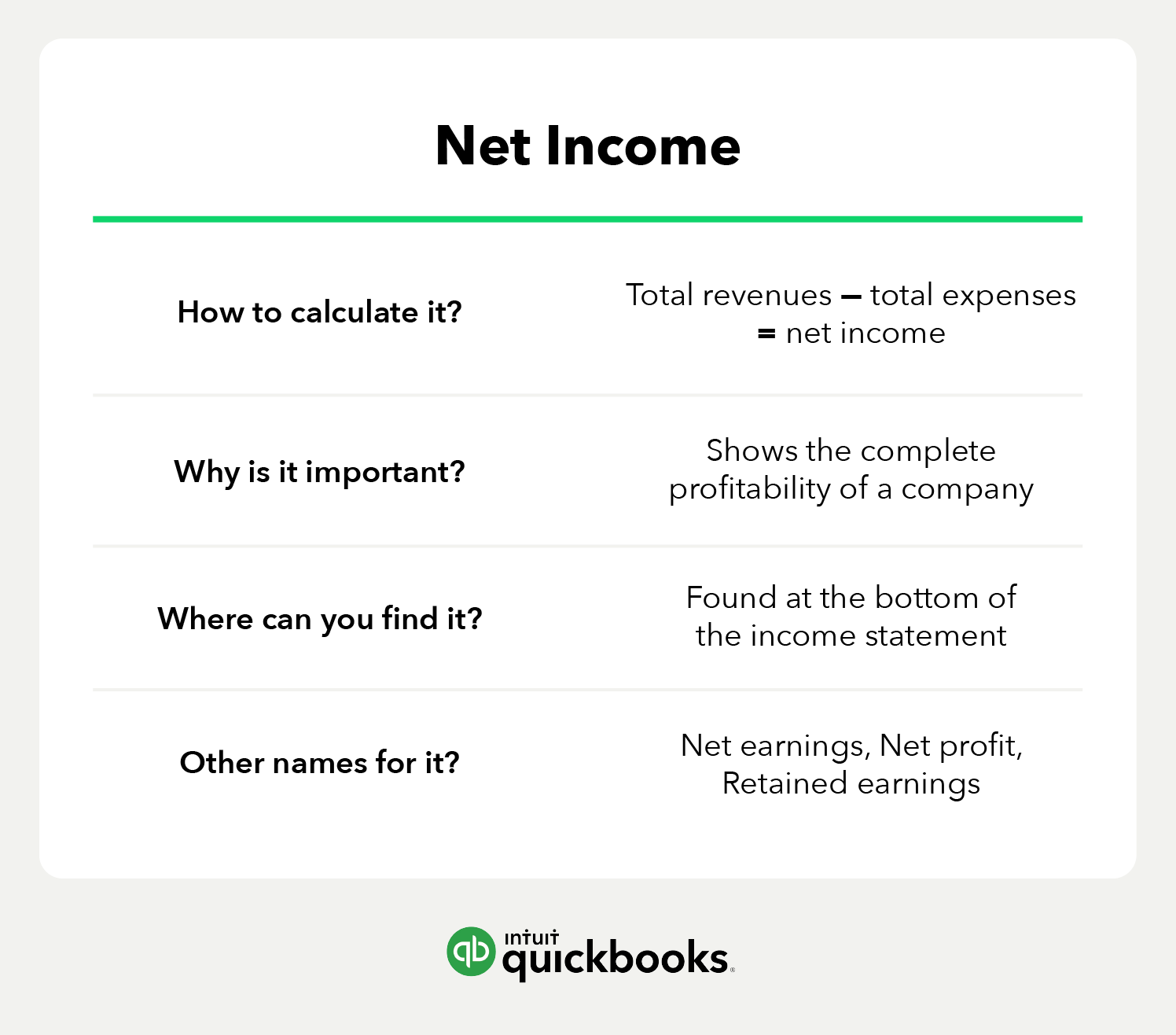

Net income may also be referred to as a companys bottom line. Net Income of the MILO Pvt. Preferred stock and other adjustments.

Suppose a company named MILO Pvt. Assess a businesss financial health. Ltd has a total revenue of 100000 and a total expense of 45800.

You can use this number to. Periodic Interest Rate Interest Expense Total Fees Loan Principal Number of Days in Loan Term. The formula for annual net income is.

Net income is the total amount of money a business earns after paying all taxes and expenses in a given period. The amount of any housing allowance provided to a member of the clergy shall not be taxable as earned income. Net income from continuing operations 16 571 000.

To express the APR as a percentage the amount must be multiplied by 100. For businesses knowing the difference between a gross annual income and net annual income is important because if its net income is a positive value it shows that the business is making a profit. Next subtract taxes from your income to determine your net annual income.

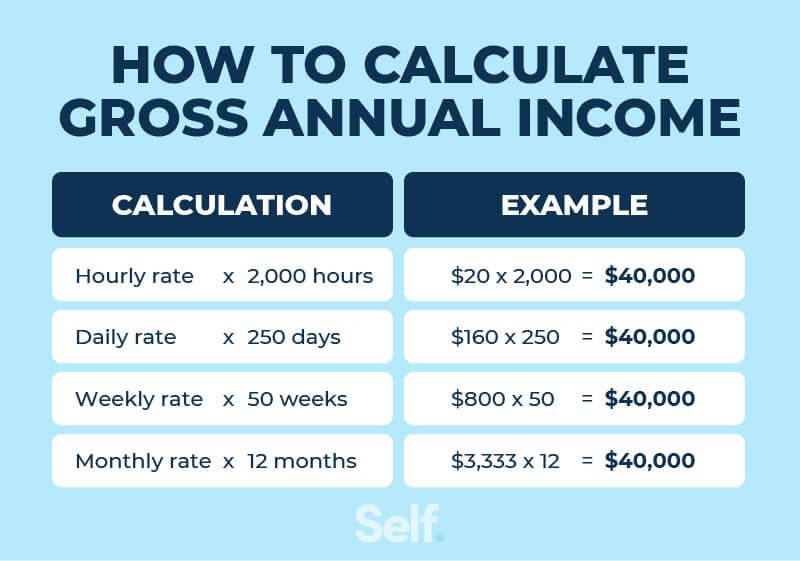

Income tax expense 19 903 000. For example if youre paid an annual salary of 75000 per year the formula shows that your gross income per month is 6250. Number of Hours in a Week.

Net Income 100000 45800. Many people are paid twice a month so its also useful to know your. Total other incomeexpenses net 1 416 000.

To illustrate the difference between net income and profit lets take a look at Apples annual income statement for fiscal year 2020. V relating to personal income tax. Its annual rate of return and its projected future value.

To show an example someone with a gross annual income of 200000 and a tax rate of 15 and a CPF deduction of 25 has a net annual income of 120000. Net income profit applicable to common shares 16. Calculate the annual gross annual income of Mathews Smith.

Based on this NOI calculation an investor can then. To finish with the same example. Below is the formula.

Its gross profit listed as gross marginrevenues minus. When you use this method for the income approach use the following formula. Net operating income equals all revenue from the property.

You determined that your gross income was 52000. Relevance and Use of Income Statement Formula. Is Calculated using below formula-Net Income Total Revenue Total Expense.

Net income 16 571 000. Net Operating Income 70000. Net Operating Income Formula Example 2.

Let us take the example of Apple Inc. He pays income taxes of 500 in the year. For example say you earn 6000 per month before taxes get taken out.

Use the below-given data for calculation. Net Operating Income Gross Operating Income 64800 Other Income1000 - Operating Expenses 15000 Net Operating Income 50800 annually. Therefore DFG Ltd generated net operating income of 70000 during the year.

The APR is calculated using the following formula. Gross income is the combination of all income including salary investments and interest on savings. Net Income 54200.

Calculate a businesss earnings per share. Use this number to compare the investments income to other properties. Ascertain if the investment earns enough to cover any loans.

Net Income for 2016 45687. Net Income Formula Example 2. Net Operating Income 500000 350000 80000.

APR Periodic Interest Rate 365 Days 100.

How To Calculate Net Income Formula And Examples Bench Accounting

Net Income The Profit Of A Business After Deducting Expenses

Net Income What Is It How Is It Measured

Net Income Formula And Calculation Example

How To Calculate Net Income Formula And Examples Bench Accounting

How To Find Net Income For Beginners Pareto Labs

What Is Net Income Formula Calculations And Examples Article

:max_bytes(150000):strip_icc()/AppleIncomeSattementDec2019-cd967d0a8f5e4748a1060f83a7e7acbc.jpg)

Net Income After Taxes Niat

What Is Annual Income And How To Calculate It Self Credit Builder

Taxable Income Formula Examples How To Calculate Taxable Income

What Is Net Income Retipster Com

How Do You Use The Roi Formula On Excel Monday Com Blog

What Is Net Income Definition Formula And How To Calculate Stock Analysis

How To Find Net Income Calculations For Business

Operating Income Formula Calculator Excel Template

What Is Net Profit And How To Calculate It Glew

Net Income Formula And Calculation Example