Sales tax calculation formula

Select an item sales tax group. 54 rows The Sales Tax Calculator can compute any one of the following given inputs for the remaining two.

Amazon Sales Tax What It Is How To Calculate Tax For Fba Sellers

Estimate your state and local sales tax deduction.

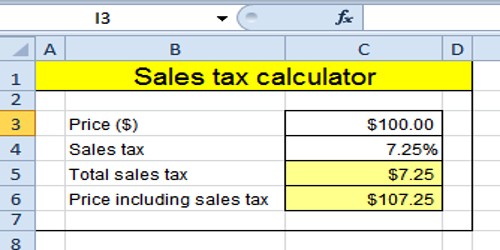

. Select the cell you will place the calculated result enter the formula B1B2 B1 is the price exclusive. Sr Special Sales Tax Rate. L Local Sales Tax Rate.

Press CTRLN on the Calculation tab to define the calculation expression for a specific sales tax code. The Sales Tax Deduction Calculator helps you figure the amount of state and local general sales tax you can claim when you itemize deductions on Schedule A Forms 1040 or. To meet the tax requirement you would do the following.

Using this method leaves one formula for calculating the total price of a purchase with tax. Tax 20000 times 5. In this condition you can easily calculate the sales tax by multiplying the price and tax rate.

Answer a few questions about yourself and large. As the Sales Tax Formula illustrates there. Calculate tier 2 tax by subtracting the limit from the amount and multiplying the result by the tier 2 tax rate 10.

An example of this type of calculation is a state sales tax of 1 percent applied to the first 65 percent of the sales amount. How much is tax. To calculate sales tax of an item simply multiply the cost of the item by the tax rate.

Calculate tier 1 tax by multiplying the limit 10000 by the tier 1 tax 6. Before-tax price sale tax rate and final or after-tax price. To calculate the sales tax that is included in a companys receipts divide the total amount received for the items that are subject to sales tax by 1 the sales tax rate.

Sales Tax gross profit cost of goods sold gross profit cost of goods sold sales tax rattle. Click the Formula designer button. C County Sales Tax Rate.

Enter the total amount that you wish to have calculated in order to determine tax on the sale. Calculate the sales tax on the washing machine. For instance in Palm Springs California the total.

Now just multiply by the purchase price to get the total price. You buy a car for 20000 dollars and pay 5 in tax. Sales Tax Rate s c l sr.

Enter the sales tax percentage. Sales Tax Deduction Calculator. S State Sales Tax Rate.

The simplest way to calculate sales tax is to use the following equation. Sales Tax Calculation Examples. A washing machine is marked for sale at 16600 inclusive of sales tax at the rate of 10.

Ex Find The Sale Tax Percentage Youtube

How To Calculate Sales Tax On Almost Anything You Buy

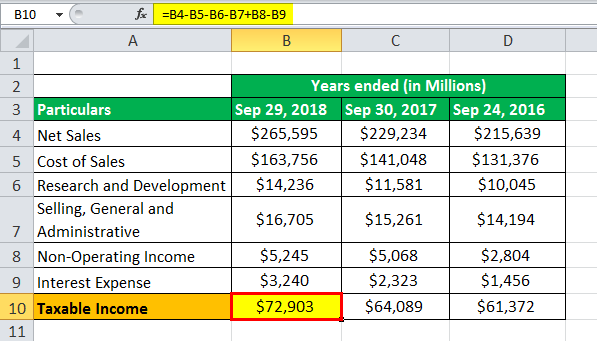

Taxable Income Formula Examples How To Calculate Taxable Income

Excel Formula Two Tier Sales Tax Calculation Exceljet

How To Calculate Sales Tax In Excel

Sales Tax Lesson For Kids Study Com

Reverse Sales Tax Calculator Calculator Academy

Find Sales Tax And Total Amount Youtube

How To Calculate Taxes And Discounts Basic Concept Formulas And Examples Cuemath

How To Calculate Sales Tax In Excel

Calculation Of Sales Tax Assignment Point

The Top How Do I Calculate Sales Tax From A Total

Effective Tax Rate Formula And Calculation Example

Sales Tax Calculator

How To Calculate Sales Tax Definition Formula Example

Calculate Tax On Item Flash Sales 51 Off Www Ingeniovirtual Com

Sales Tax Decalculator Formula To Get Pre Tax Price From Total Price